In the realm of corporate governance, the issue of executive compensation has long been a subject of scrutiny and debate.

The recent case involving Tesla CEO Elon Musk’s pay package has once again brought this matter to the forefront of public discourse.

The contentious nature of Musk’s compensation package, which was deemed flawed and unfair by a Delaware judge, has sparked a myriad of questions regarding the valuation of executive worth and the intricacies of determining fair compensation in the corporate world.

Elon Musk, a figure renowned for his innovative vision and leadership in the technology and automotive industries, has undeniably played a pivotal role in the success and growth of Tesla, Inc.

As such, the question of his worth and the appropriate compensation for his contributions becomes a complex matter that delves into various dimensions of corporate governance, financial valuation, and ethical considerations.

The disparity between executive compensation and that of the average employee is a perennial source of contention.

It is a widely acknowledged fact that CEOs often receive remuneration that is significantly higher than that of their employees.

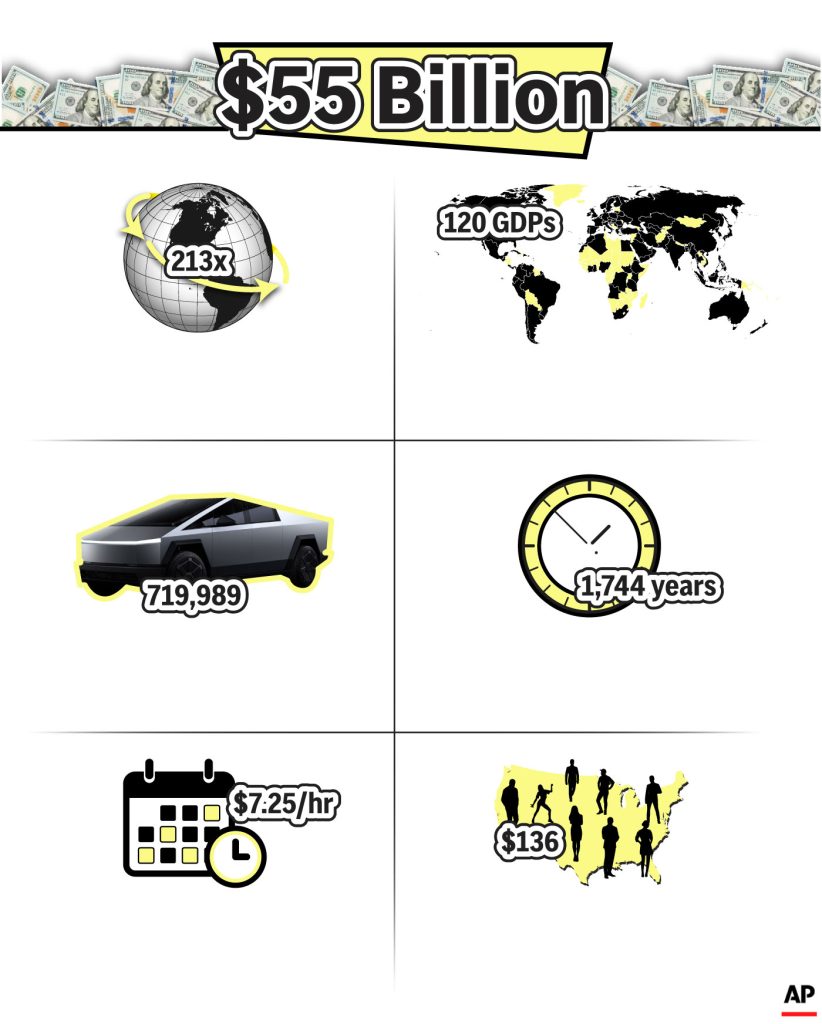

The magnitude of Musk’s proposed pay package, valued at an unprecedented $55.8 billion, raises eyebrows and prompts a critical examination of the rationale behind such exorbitant compensation.

The ruling by Chancellor Kathaleen St. Jude McCormick, which invalidated the compensation package, underscores the inherent challenges in determining fair and just compensation for top executives.

The characterization of the package as “the largest potential compensation opportunity ever observed in public markets by multiple orders of magnitude” highlights the extraordinary nature of the case and the need for a thorough reevaluation of executive pay structures.

In the context of evaluating Musk’s worth, it is imperative to consider the multifaceted dimensions of his contributions to Tesla and the broader impact of his leadership on the company’s performance and strategic direction.

Musk’s role as a visionary innovator, driving force behind technological advancements, and the face of Tesla’s brand presence adds layers of complexity to the assessment of his worth.

Furthermore, the determination of executive worth extends beyond individual performance metrics and financial indicators.

It encompasses intangible elements such as leadership, strategic vision, and the ability to inspire and mobilize teams towards achieving ambitious goals.

These qualitative aspects, while challenging to quantify, hold significant weight in evaluating the true value that an executive brings to an organization.

The intricacies of executive compensation are further compounded by the dynamic and competitive nature of the industries in which companies like Tesla operate.

The rapid pace of technological innovation, global market fluctuations, and the evolving landscape of corporate governance all contribute to the complexity of determining appropriate compensation for top executives.

The case of Musk’s pay package underscores the necessity for a more transparent and rigorous process in establishing executive compensation.

It calls for greater accountability, ethical considerations, and alignment with long-term value creation for stakeholders.

The governance structures and mechanisms that oversee executive pay must be robust, ensuring that compensation packages are equitable, justifiable, and reflective of sustained performance and value creation.

In conclusion, the evaluation of Elon Musk’s pay package and his worth as a CEO encapsulates the intricate and multifaceted nature of executive compensation.

It prompts a critical examination of the processes, governance, and ethical considerations that underpin the determination of fair and just compensation for top executives.

The complexities inherent in assessing executive worth necessitate a holistic approach that encompasses both quantitative and qualitative dimensions, while upholding principles of transparency, accountability, and long-term value creation for all stakeholders.

The judge’s ruling on the lack of independence of Tesla’s board from Musk has sparked a contentious debate over executive compensation and corporate governance.

Musk’s legal team argued that the compensation package was necessary to incentivize him to stay, but the judge dismissed this reasoning as being swayed by the allure of Musk’s celebrity status.

The question raised by McCormick about the necessity of the plan for Tesla’s success remains unanswered.

Supporters of Musk contend that his unique role and contributions to Tesla’s growth justify a compensation structure that diverges from traditional CEO pay standards.

They argue that Musk’s leadership has been instrumental in propelling Tesla to become the world’s most valuable automaker and driving the widespread adoption of electric vehicles.

The issue of CEO pay is a complex one, with corporate boards often benchmarking against industry peers and employing intricate formulas to determine appropriate compensation levels.

The case involving Tesla and Musk has brought to light the intricacies and controversies surrounding executive compensation in the corporate world.

The issue surrounding Elon Musk’s compensation package has sparked significant debate within the corporate law community, with experts emphasizing the potential legal challenges that may arise unless Tesla’s board takes decisive action.

According to corporate law specialists, any new compensation arrangement for Musk is likely to face legal scrutiny unless the board either collectively steps down or meticulously adheres to a process aimed at safeguarding shareholders’ interests by implementing a considerably reduced package.

Charles Elson, a distinguished retired corporate law professor and founder of the corporate governance center at the University of Delaware, expressed grave concern, noting, “This is just a mess for them.

They kowtowed to this apparent superstar with poor results.” Notably, Elson, with over three decades of experience, highlighted this as the first instance where he recalls a judge invalidating an executive compensation plan at a public company.

Lawyers representing Musk and the directors have defended the plan, asserting that it was fairly negotiated by an independent compensation committee and received shareholder approval.

However, Elson pointed out that shareholders may not have been fully informed, as Musk essentially negotiated with himself, potentially impacting the approval process.

In light of these complexities, it is evident that any future compensation package for Musk will be met with legal challenges unless the board takes decisive and transparent action to address these concerns.